One of the major topics discussed in the precious metals community is the manipulation of the gold and silver prices by the large bullion banks. Many precious metals analysts point to the massive commercial short positions held by JP Morgan and Scotiabank as the root cause for the low silver price. While I agree that the bullion banks’ massive short contracts are controlling the silver price to a certain degree, there’s another factor that is overlooked by the majority of precious metals analysts.

One of the major topics discussed in the precious metals community is the manipulation of the gold and silver prices by the large bullion banks. Many precious metals analysts point to the massive commercial short positions held by JP Morgan and Scotiabank as the root cause for the low silver price. While I agree that the bullion banks’ massive short contracts are controlling the silver price to a certain degree, there’s another factor that is overlooked by the majority of precious metals analysts.

According to Ed Steers’ recent article titled, JPMorgan’s Silver Short Position Now At 195 Million Ounces, he stated the following:

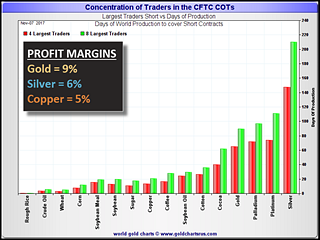

For the current reporting week, the Big 4 are short 148 days of world silver production-and the ‘5 through 8’ large traders are short an additional 62 days of world silver production-for a total of 210 days, which is seven months of world silver production, or about 510.3 million troy ounces of paper silver held short by the Big 8. [In the COT Report last week, the Big 8 were short 203 days of world silver production.]

This post was published at SRSrocco Report on NOVEMBER 25, 2017.